Nebraska Property Tax

Nebraska Property Tax Credit | Nebraska Department of Revenue

The Nebraska Department of Revenue (DOR) has created a GovDelivery subscription category called "Nebraska Property Tax Credit." Click here to learn more about this free subscription service, as well as sign up for automatic emails when DOR updates information about this program. Updates to the Nebraska Property Tax Look-up Tool

https://revenue.nebraska.gov/about/nebraska-property-tax-credit

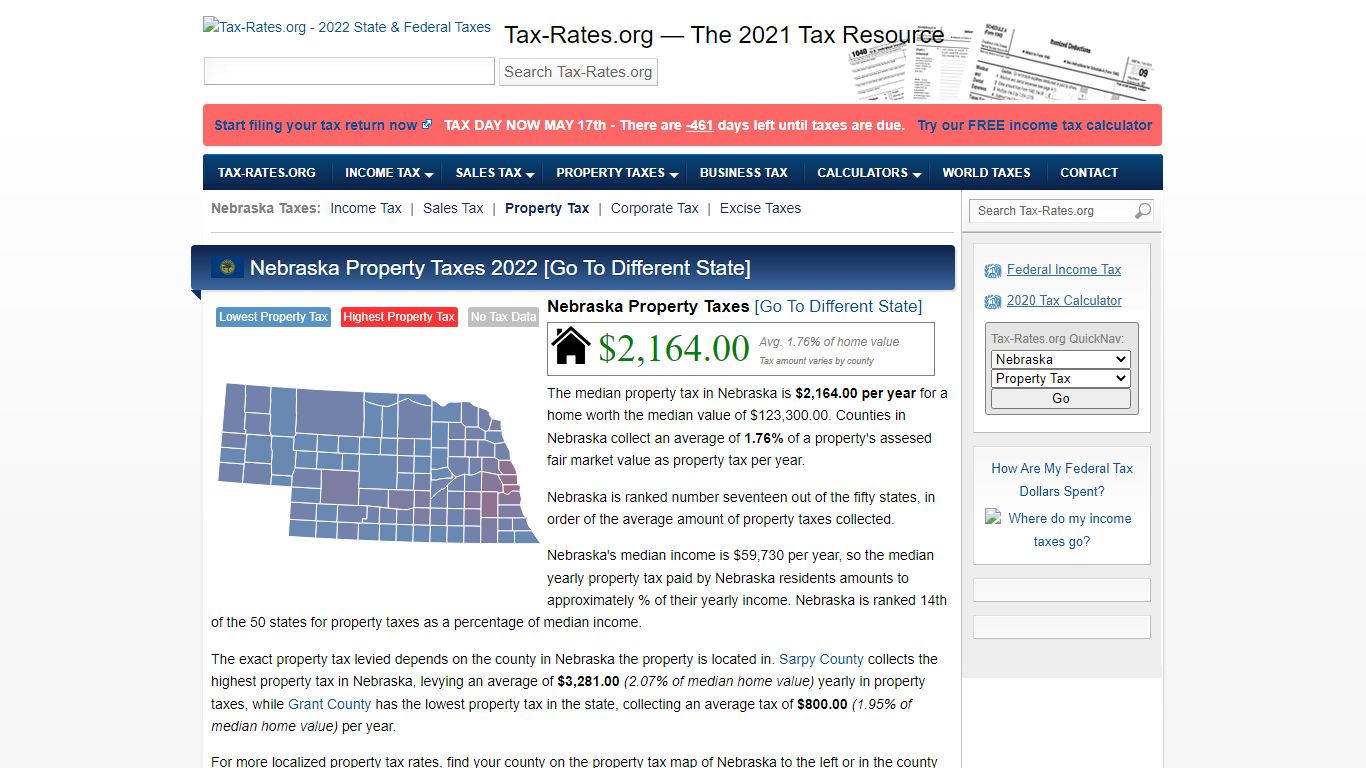

Nebraska Property Taxes By County - 2022 - Tax-Rates.org

Nebraska Property Taxes [Go To Different State] $2,164.00 Avg. 1.76% of home value Tax amount varies by county The median property tax in Nebraska is $2,164.00 per year for a home worth the median value of $123,300.00. Counties in Nebraska collect an average of 1.76% of a property's assesed fair market value as property tax per year.

https://www.tax-rates.org/nebraska/property-tax

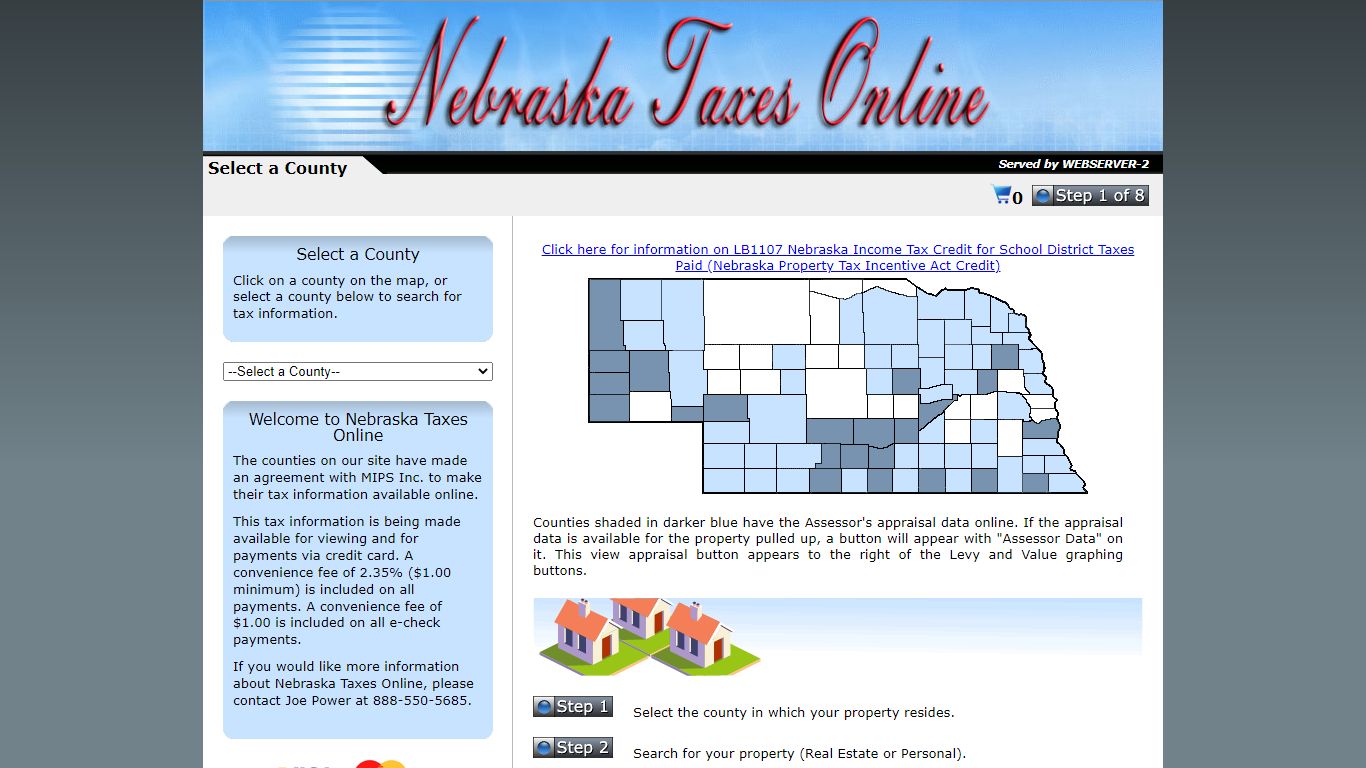

Nebraska Taxes Online

A convenience fee of 2.35% ($1.00 minimum) is included on all payments. A convenience fee of $1.00 is included on all e-check payments. If you would like more information about Nebraska Taxes Online, please contact Joe Power at 888-550-5685. Not all counties may accept all 4 card types or e-checks.

https://nebraskataxesonline.us/

Nebraska Department of Revenue

The Nebraska Property Tax Look-up Tool is OPEN, and all 2021 property tax and payment records are available. Nebraska Property Tax Credit Information 5/17/2022 For Businesses For Individuals Tax Professionals Property Assessment Local Governments Quick Links Forms Register a Business Sales Tax Rate Finder Online Services Refund Information

https://revenue.nebraska.gov/

Property Tax in Nebraska [2022 Guide] Rates, Due Date, Exemptions ...

The city’s conduct of real estate taxation must not violate Nebraska statutory rules. Taxation of real estate must: [1] be equal and uniform, [2] be based on present market value, [3] have a single appraised value, and [4] be held taxable in the absence of being specially exempted. Taxpayer’s rights to timely notice of rate hikes are also mandated.

https://directtaxloan.com/guides/property-tax-ne/![Property Tax in Nebraska [2022 Guide] Rates, Due Date, Exemptions ...](./screenshots/nebraska-property-tax/4.jpg)

Property Assessment - Nebraska Department of Revenue

Property Assessment Committed to helping taxpayers understand and meet their tax obligations. What's New 2022 PAD Legislative Changes 6/23/2022 Updated Certificate Holders and Continuing Education Hours for Certificate Holders 5/25/2022 County Assessor/Deputy County Assessor Examination, August 11, 2022 5/25/2022 View More Notifications

https://revenue.nebraska.gov/PAD

The Basics of Nebraska’s Property Tax - Nebraska Legislature

Today, property tax is the primary revenue raising tool for political subdivisions, and in fiscal year 2018-2019, property tax revenue comprised approximately 37.4 percent of all state and local tax revenue collected in Nebraska. Property tax calculation can be summarized by: Property tax = (Assessed Taxable Property x Rate) – Credits.

https://www.nebraskalegislature.gov/pdf/reports/research/propertytax2020.pdf

Nebraskans Need Major Property Tax Cuts - Pete Ricketts

This fiscal responsibility will set Nebraska up for growth and prosperity for years to come. If you want to voice your support for tax relief or have ideas on how we can provide further relief to Nebraskans, call my office at 402-471-2244, or email us at [email protected].

https://governor.nebraska.gov/press/nebraskans-need-major-property-tax-cuts

Property | Property Assessment - Nebraska Department of Revenue

Contact. Property Assessment Division. 301 Centennial Mall South. PO Box 98919. Lincoln, NE 68509-8919. 402-471-5984. Contact Us

https://revenue.nebraska.gov/PAD/property

County Assessors and Parcel Search | Property Assessment

Nebraska Assessors Online or Nebraska Taxes Online (operated by Nebraska Association of County Officials) Search by County Parcel Adams County Assessor Jackie Russell 500 W 4th St Room 107 Hastings, NE 68901 402-461-7116 http://www.adamscounty.org/county-assessor

https://revenue.nebraska.gov/PAD/county-assessors-and-parcel-search